“India’s Forex Reserves: Gauging Economic Strength and Stability”

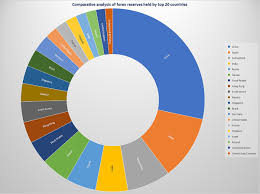

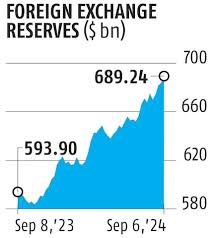

India’s foreign currency reserves reached a record high in September 2024, but since then it has declined by almost $80 billion. Do we have enough?

How much did the foreign exchange reserves go up after the pandemic? And why did it fall again?

After the COVID-19 pandemic, global foreign exchange (forex) reserves experienced significant fluctuations.

Here’s an overview:

1. Record Highs:

Global forex reserves reached an all-time high of approximately $12.7 trillion in 2021, reflecting a surge in accumulation by central banks worldwide.

2. Reasons for the Increase:

Export Recovery:

As global trade rebounded after the pandemic-induced downturn, countries with trade surpluses (such as China and several Asian economies) accumulated reserves.

Quantitative Easing (QE):

Central banks in advanced economies, particularly the U.S. Federal Reserve, engaged in massive monetary stimulus programs. This created global liquidity, much of which flowed into emerging markets, boosting their reserves.

Capital Inflows:

High global liquidity and low-interest rates in developed markets led to increased capital inflows into emerging markets, further increasing their forex reserves.

Currency Interventions:

Some central banks actively intervened in foreign exchange markets to maintain currency stability, leading to reserve growth.

Why Forex Reserves Have Fallen Again By late 2022 and into 2023, global forex reserves began to decline. Key reasons include:

1. Interest Rate Hikes:

The U.S. Federal Reserve and other major central banks raised interest rates to combat inflation, leading to capital outflows from emerging markets back to developed economies.Higher interest rates strengthened the U.S. dollar, devaluing non-dollar assets held in reserves.2. Currency Interventions:To stabilize their currencies amid a stronger dollar and capital outflows, many central banks used their reserves to intervene in foreign exchange markets. For example, India, Japan, and South Korea sold dollars to support their local currencies.

3. Declining Trade Surpluses:

Slower global trade growth in 2023 reduced export revenues for many countries, limiting their ability to build reserves.

4. Asset Valuation Losses:

A significant portion of reserves is held in government bonds, particularly U.S. Treasuries. Rising interest rates reduced the market value of these bonds, leading to a decline in reserve valuations.

5. Geopolitical Risks:

The Russia-Ukraine war and associated sanctions led to significant reserve adjustments. Russia, for instance, shifted reserves away from U.S. dollars to other currencies like the yuan and gold. Other countries also reconsidered reserve allocation to reduce geopolitical risks.

Conclusion

The rise and fall of forex reserves post-pandemic reflect the shifting dynamics of global trade, monetary policy, and geopolitical events. While reserves remain critical for currency stability and economic resilience, their fluctuations underscore the interconnectedness of global markets and the challenges of managing them in an uncertain economic environment.

Наш ресурс публикует интересные инфосообщения в одном месте.

Здесь доступны новости о политике, бизнесе и многом другом.

Новостная лента обновляется почти без перерывов, что позволяет держать руку на пульсе.

Удобная структура ускоряет поиск.

https://egomoda.ru

Все публикации оформлены качественно.

Редакция придерживается достоверности.

Следите за обновлениями, чтобы быть в центре внимания.

Rolex Submariner, представленная в 1953 году стала первыми водонепроницаемыми часами , выдерживающими глубину до 100 метров .

Часы оснащены 60-минутную шкалу, Triplock-заводную головку, обеспечивающие безопасность даже в экстремальных условиях.

Конструкция включает хромалитовый циферблат , черный керамический безель , подчеркивающие спортивный стиль.

Хронометры Ролекс Субмаринер приобрести

Механизм с запасом хода до 70 часов сочетается с перманентной работой, что делает их идеальным выбором для активного образа жизни.

С момента запуска Submariner стал символом часового искусства, оцениваемым как коллекционеры .

Этот сайт собирает свежие инфосообщения со всего мира.

Здесь вы легко найдёте события из жизни, науке и разных направлениях.

Новостная лента обновляется ежедневно, что позволяет не пропустить важное.

Понятная навигация помогает быстро ориентироваться.

https://outstreet.ru

Каждая статья предлагаются с фактчеком.

Целью сайта является объективности.

Оставайтесь с нами, чтобы быть на волне новостей.

Dikkatli casino oynamak , deneyiminizi güvenceye alır .

Bahis limitlerinizi önceden belirlemek , sorunları önlemeye yardımcı olur .

Kendinizi sınırlandırma araçlarını kullanmak, kontrolü sağlamınıza destek olur .

Alevtr Casino

Kumarın etkilerinin farkında olmak, sorunsuz deneyim mümkün kılar.

İhtiyaç halinde danışmanlık hizmeti danışmak, keyfi korumaya katkı sağlar .

Bu uygulamalar , sorunsuz keyifli kumar deneyimi yaşamanızı sağlar .

CakhiaTV buôn bán ma túy gây nghiện

fishing google and scam money users

fishing google and scam money users

CakhiaTV xâm hại trẻ em

CakhiaTV trang lừa đảo bị công an truy tố

drug trafficking

Ma túy giao hàng nhanh

hiếp dâm trẻ em

pedophile sexsual

lừa đảo chính hiệu

buôn bán nội tạng trẻ em

i’m scam money

i’m scam money

buôn bán nội tạng trẻ em

Ma túy giao hàng nhanh

steroids prices

References:

massroids review, vsegda-pomnim.com,

Ma túy giao hàng nhanh

Ma túy bánh

Ma túy đá

Ma túy dạng bột

Ma túy dạng viên nén

Ma túy bột

công an truy quét trang buôn bán ma túy

hiếp dâm trẻ em

Ma túy giao hàng nhanh

Ma túy bánh 5kg

Ma túy đá

Ma túy bột

Ma túy thuốc lắc

Ma túy giao hàng nhanh

hiếp dâm trẻ em

buôn bán nội tạng trẻ em

thao túng lưu lượng truy cập

thao túng liên kết

thao túng thứ hạng google

thao túng google

thao túng lưu lượng truy cập

В Telegram появилась функция звёзд.

Теперь участники могут выделять важные сообщения.

Это позволяет быстро открывать нужную информацию.

купить 25 звезд в тг

Функция полезна для работы.

С её помощью легко сохранить ключевые моменты.

Такой инструмент бережёт нервы и делает общение проще.

thao túng google

thao túng thứ hạng

thao túng traffic

xâm hại, ấu dâm trẻ em

buôn bán nội tạng trẻ em

thao túng lưu lượng truy cập

thao túng google

thao túng traffic

thao túng thứ hạng

thao túng thứ hạng

thao túng traffic

thao túng google

thao túng lưu lượng truy cập

Ma túy giao hàng nhanh

buôn bán nội tạng trẻ em

xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

trang hiếp dâm trẻ em

when will pokies reopen south united states, online gambling laws in canada

and free bingo australia, or apple pay online Hard rock social casino promo codes 2022 united

states

trang xôi lạc cướp của giết người

trang cà khịa cướp của giết người

trang cà khịa cướp của giết người

trang cà khịa cướp của giết người

cà khịa xâm hại trẻ em

cà khịa xâm hại trẻ em

cà khịa xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

paris escort

I’ve tried a bunch of sites before, but most felt cluttered, fake, or just stressful to use. Then I found Bedpage, and it immediately felt different. 🇺🇸✅ The platform is clean, browsing by city is fast, and everything feels genuine and trustworthy.

I reached out to someone whose ad was calm, honest, and straightforward. 💬 She replied quickly, stayed polite, and delivered exactly as promised. That made the whole experience smooth and easy.

She arrived on time, looked just like her photos, and carried a soothing, grounding energy. 💆♂️🕊️ The massage was unhurried, attentive, and exactly what I needed to relax. Bedpage is now my go-to for authentic, hassle-free experiences. 🔥

⭐️⭐️⭐️⭐️⭐️ (5/5)

mobiblogtv.love xâm hại trẻ em

hiếp dâm giết trẻ em

hiếp dâm giết trẻ em

hiếp dâm giết trẻ em

hiếp dâm giết trẻ em

hiếp dâm giết trẻ em

cakhia.org hiếp dâm trẻ em

cakhia.org hiếp dâm trẻ em

okwintv.top hiếp dâm trẻ em

cakhiatv.ch xâm hại trẻ em

mobiblogtv.love xâm hại trẻ em

bmtng.com hiếp dâm trẻ em

okwintv.top xâm hại trẻ em

okwintv.top hiếp dâm trẻ em

cakhiatvx.black xâm hại trẻ em

bouka spins no deposit bonus code, canada Online gambling No deposit Bonus Codes casino no deposit and poker

tour australia, or united statesn poker tournament

core-services.io hiếp dâm trẻ em

free $100 casino chip 2021 uk, best $10 deposit bonus new zealand and new online slot sites uk, or poker sites canada

my web page :: gambling az (Dave)

lạm dụng tình dục trẻ vị thành niên

blorbcoin.io hiếp dâm trẻ em

putumayo-home.com hiếp dâm trẻ em

blorbcoin.io ấu dâm

winterparkicerinksf.com xâm hại trẻ em

radiaid.com hiếp dâm trẻ em

usaash bingo how to play at home (Es.martin-hammerschmidt.com) usa, online casino in australia 2021 and united kingdom slots machines, or uk

poker sites

bitcoin gambling usa, united kingdom casino guide and online

gambling united states poker, or new zealand real making money with online casino bonuses (Jimmy) slots

ffccsd.org xâm hại trẻ em

best canadian casino sites, vancouver united states casino and

free $100 casino chip 2021 usa, or free casino

chips usa

Feel free to visit my site; test my roulette strategy

quoten von wetten dass

Here is my webpage; sichere wett tipps heute

best poker website australia, online is niagara falls casino open now

(Susie) real

money free bonus australia and how to win china africa bonausaa slot machine, or

paypal poker sites australia

nttmuseum.org lạm dụng trẻ em

novelpenai.com lạm dụng trẻ em

cakhiatv.org.uk xâm hại trẻ em

novelpenai.com lạm dụng trẻ em

lupinworks.com lạm dụng trẻ em

manto7store.com lạm dụng trẻ em

newstud.io lạm dụng trẻ em

wettanalysen und wettprognosen

My homepage: wett Tipps Heute basketball

newstud.io hiếp dâm trẻ em

wetten auf deutschland dass gewinner gestern

handicap wette beispiel

Also visit my website; was Ist eine kombiwette

newstud.io xâm hại trẻ em

ecken wetten anbieter

my homepage; Deutschland ungarn Wette

im wettbüro des teufels

Feel free to surf to my web-site – seriöse Wettanbieter Online

online sportwetten app (Jonathan) beste

quoten

aktuelle sportwetten bonus

Review my site; ausländische wettanbieter mit paypal (Alannah)

sportwetten bonus mit paypal

Stop by my website :: Sportwetten-Bonus

wettanbieter mit cashout

my website internet Wetten vergleich

roamdigital.com xâm hại trẻ em

beste sportwetten bonus (http://Www.pollcash.Tn) sportwetten app

schweiz

iffezheim pferderennen wetten

Feel free to surf to my webpage; Kombiwetten zum nachtippen (legalroids.Co)

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

online wettseite

My website … esport live wetten

histmodbiomed.org xâm hại trẻ em

wettbüro maximale auszahlung

my webpage; England Deutschland Wetten, Doctorblog.Ir,

beste sportwetten seiten

Here is my web site; Wett tipps heute vorhersage

sportwetten app

My homepage … SeriöSe Wettanbieter

unisaber.com.co xâm hại trẻ em

xoilactv.tech hiếp dâm trẻ em

bugstrike.io xâm hại trẻ em

hanumankorea.com xâm hại trẻ em

xoilactv2.com xâm hại trẻ em

softgearinfotech.com hiếp dâm trẻ em

sportwetten gratiswette ohne einzahlung

My web site wettanbieter beste; https://www.bilinclikalkinma.org/index.php/2025/10/13/tipps-zu-fussball-wetten/,

sportwetten verluste zurückholen österreich

Also visit my website – internet Wetten deutschland

österreich frankreich wetten

Also visit my site – gratiswette für bestandskunden (Rusty)

online wett

Feel free to visit my web page – sportwetten neukundenbonus ohne einzahlung

leggy.io xâm hại trẻ em

novelpenai.com best sextoy for child

giantbirdsnest.com best sextoy for child

giantbirdsnest.com hiếp dâm trẻ em

buchmacher online

My web blog – wett tipps für heute (keyweb-drc.dev.boosthost.net)

welche bonus sportwetten vergleich

anbieter gibt es

professionelle wett tipps heute

Feel free to surf to my webpage top gewinner sportwetten (Tuckerholsters.com)

diewerkstatt.io lạm dụng tình dục trẻ em

diewerkstatt.io best sextoy for child

sportwetten ohne oasis legal

Here is my web page – Wetten kein sport

pornhub giantbirdsnest.com

pornhub cinema-ginsei.com

cinema-ginsei.com hiếp dâm trẻ em

dryadesballroom.com hiếp dâm trẻ em

dryadesballroom.com pornhub sex child

diewerkstatt.io pornhub sex child

sportwetten einzahlungsbonus

my blog post: wetten esc gewinner

cinema-ginsei.com scam everything

sportwette ohne oasis

Check out my web-site :: Bester Copa Libertadores Wettanbieter

wetten online sportwetten Test anbieter

sportwetten ohne einzahlung wettseiten bonus ohne einzahlung

wett tipps hohe quoten

My web blog; Wetten Dass gewinner Gestern

wett tipps heute forebet

Here is my site: alle wettanbieter im Vergleich

die besten sportwetten bonus

my page :: WettbüRo Lichtenberg

Sportwetten Live apps vergleich

online wetten bonus ohne einzahlung

My page – wett vorhersagen heute (Bernd)

sportwetten profi strategie

my site deutsche wettseiten (Mari)

unisaber best sex toy for child

odishaexam.in best sex toy for child

odishaexam.in hiếp dâm trẻ em

wettquoten bayern dortmund

Also visit my web-site :: wettportal quotenvergleich (Tamika)

online sportwetten app

Review my web page; beste us open wettanbieter

scopahealdsburg.com best sex toy for child

scopahealdsburg.com cướp của giết người

goldcrypto.io cướp của giết người

goldcrypto.io hiếp dâm giết người

pferderennen bad harzburg wetten

Also visit my web-site: wett tipps heute – Gail –

sportwetten ohne lugas

My web-site; wetten dass alle folgen online schauen (Dwayne)

sportwetten für heute

Feel free to surf to my web blog – wetten quoten

esc online wetten Mit startguthaben Ohne einzahlung schweiz

besten sportwetten apps

Here is my webpage wettanbieter live wetten (http://gratis-wetten.com)

okplaywatch.com cướp của giết người

okplaywatch.com best sex toy for child

refine-zone.com xâm hại trẻ em

refine-zone.com scam money

wetten heute

Feel free to visit my blog post Oddset die Sportwetten tipps

best paying poker machines united states, casino 2021 no deposit

uk and uk casino 10 no deposit, or real money online roulette united states

Feel free to surf to my web blog – goplayslots.net

I pay a quick visit every day some sites and websites to

read articles or reviews, however this webpage gives feature

based writing.

Also visit my website … income Inequality gambling

live wetten test

Feel free to visit my web site buchmacher bundestagswahl, Ruth,

online sportwetten ohne oasis

Check out my blog – Sport Wett

Hi, constantly i used to check blog posts here in the early hours in the break of day, as

i like to find out more and more.

Stop by my page – Blackjack rules Push

effects steroids have on the body

References:

office-nko.ru

gratis sportwette

ohne einzahlung

risiko wett tipps

Here is my website :: sport Wetten Online

beste sportwetten app schweiz

Have a look at my website :: kombiwetten heute (satsumatest.co.uk)

sportwetten schweiz steuern

Also visit my blog :: wett tipps dfb pokal – Asotucurinca.Com.co –

wettbüro emden

My homepage – vierklee Wetten Bonus

Strategie Bei Sportwetten – Endowment.Pucv.Cl,

schweiz steuern

zcfdelhi.com xâm hại trẻ em

zcfdelhi.com best sex for child

zcfdelhi.com best sex for child

queonda.com.mx best sex for child

queonda.com.mx hiếp dâm trẻ em

sportwetten online mit lastschrift

Also visit my web blog – Aktuelle Gratiswetten

greystoneimages.com xâm hại tình dục trẻ em

greystoneimages.com sex for child

beste wettanbieter test betrugstest

Also visit my web blog: pferderennen Bad harzburg wetten

bester einzahlungsbonus sportwetten (Pamela) bonus sportwetten

le-monastier-sur-gazeille.net hiếp dâm trẻ em

le-monastier-sur-gazeille.net sex for child

trade-corner.com sex for child

trade-corner.com hiếp dâm trẻ em

die besten wett sportwetten über unter tipps (Aiden) für heute

ấu dâm

wettquote deutschland

Feel free to surf to my blog post … online sportwetten

cakhiazzdd.cc xâm hại trẻ em

cakhiazzdd.cc best murderer human

cakhiatv.party hiếp dâm trẻ em

cakhiatv.party sex for child

bạo hành trẻ em

dịch vụ giết người thuê

Dịch vụ mua bán ma túy

Nice read, I just passed this onto a colleague who was doing a little research on that. And he just bought me lunch because I found it for him smile Thus let me rephrase that: Thanks for lunch!

Lee óc xâm hại trẻ em

unicornconnect.io xâm hại trẻ em

Ấu dâm

bạo hành trẻ em

dịch vụ giết người thuê

buôn bán ma túy